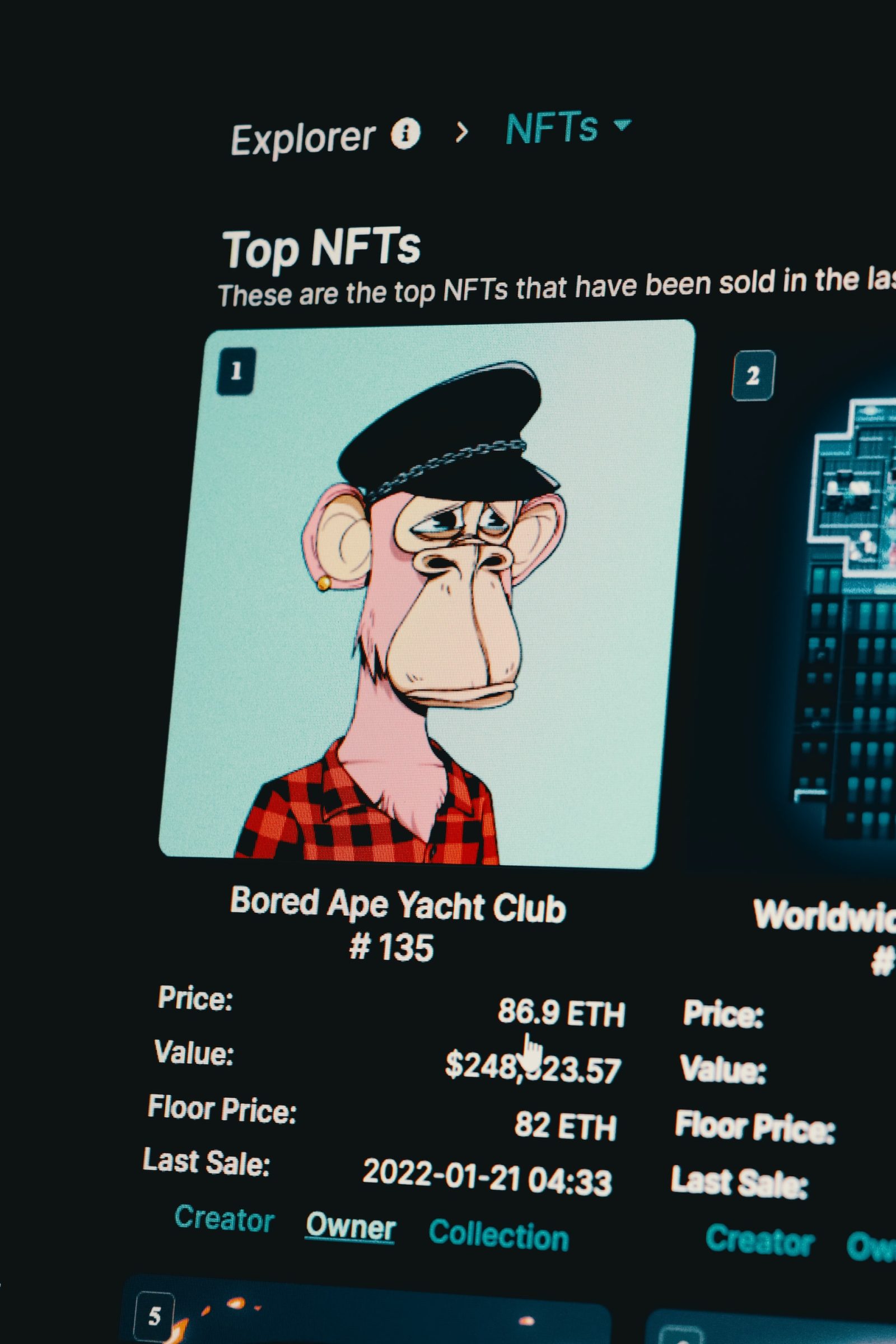

For a brief period in 2021, NFTs were all anyone could talk about. And with a piece being sold for as high as $91.8 million, why wouldn’t they be? But, beyond the obvious opportunity to make a lot more profit, NFTs offered artists and buyers a way to democratise the sale of art and bypass the middlemen (read our introductory article to NFTs here). Art here could mean any digital item, from an animated GIF to a trading card, but every item is unique with a defined owner.

This democratisation, however, comes at a price. NFTs or Non-Fungible Tokens are based on blockchain technology, with many being a part of the Ethereum blockchain. And like all crypto-based assets, their worth is subject to wild price fluctuations in the cryptocurrency market.

Cryptocurrencies have not fared too well this year, losing $2 trillion in value since the most recent high of 2021. At the time of writing this post, Bitcoin was trading for under $20,000, well below an all-time high of nearly $69,000 in November 2021 and Ether had also lost 75% of its value since then.

This comes after what experts call a burst in the NFT’ bubble’ of 2021. As of June 2022, daily average sales had fallen by 92% and active NFT wallets by 88%. Perhaps one of the clearest indications of this is the auctioning off of a Bored Ape NFT, valued at $350,000 in August 2021, for just $115 in March 2022.

With all that’s happening, the million-dollar question remains: What does this mean for the artists? A difficult but important question for Nigerian artists especially, many of whom leveraged this technology to build a global profile and connect to buyers outside their local markets.

Nigerian visual artist and illustrator, Nengi Uranta, who has extensive experience with selling art as NFTs dismisses the claim that they were just a passing fad and believes strongly in their relevance.

“I believe NFTs are still relevant due to its potential to bring visibility to artists who would otherwise be overlooked. It may feel as if it is losing its relevance but curiosity towards the ‘web3’ space, which NFTs are only a part of, and all its possibilities is still very much present,” she opined.

In her vision for the future of NFTs, she predicts a shift to the more collectable, authentic and rare nature of art instead of the current ‘pfp’ or profile picture projects that abound.

“This is not to say that visibility for the local artist will only happen if they sell their work as NFTs though. I think we are seeing a shift in focus from large (10k “pfp”) projects to 1 of 1 or limited edition pieces of more authentic art (and music) which collectors may hold as the artist grows and as their work increases in value.

To say it is a short but glorious run is to, perhaps, summarise it before we see its true potential.”

The future of NFTs, while it may be hard to predict, is not entirely bleak. With the strong communities formed over this new technology and the culture shift that has happened as a result. It is not unreasonable to believe that a resurgence is in the near future.

That future though, will require some changes. There will be more creative uses for NFTs and a need for more value for money. Interoperability with the natural world will be necessary, and as NFTs and Web3 gain more popularity, the focus may shift from collectability to the utility of these tokens. Blockchain technology’s transparency and decentralisation will be crucial for mass adoption and are the building blocks for more applications of this new technology.

In the end, NFTs are a nascent technology, and anyone in this maturing market must expect adjustments to be made along the way. These adjustments may be challenging, but sometimes that’s the price it takes.